Back in early 2021, the Gamestop stock saga turned the financial world upside down. Who would’ve thought that a video game retailer would shake Wall Street to its core? This wild ride not only changed stock market rules but also flipped the script on how retail investors interact with the big institutional firms. Now, in 2026, the ripples of this phenomenon continue to resonate through the investment landscape. So, let’s dive deep into this fascinating saga and its lasting impact!

7 Ways Gamestop Stock Revolutionized Retail Investing

1. Democratization of Investing

Gamestop stock sparked a revolution in retail investing, making financial markets more accessible than ever. Before this, the big shots on Wall Street held all the power. Thanks to platforms like Robinhood and Webull, regular folks could buy and sell stocks with just a few taps on their smartphones. It’s like giving everyone a shot at the financial pie, allowing millions to jump in and shake things up!

2. Rise of the Meme Economy

Did you ever think memes could influence the stock market? Well, here we are! The meteoric rise of Gamestop stock introduced the “meme economy,” where users on Reddit’s WallStreetBets cooked up investment strategies dripping with humor and camaraderie. Remember when people started talking about meme stocks? It became a buzzword synonymous with wild price swings, capturing the attention of younger and tech-savvy investors eager for a slice of the action.

3. Short Selling Challenges

Let’s talk short selling—this term danced into the spotlight during the Gamestop stock saga! With short interest hitting over 140% of its float, folks began questioning the ethics of these financial practices. Suddenly, a spotlight was on market manipulations that many investors overlooked. Might this have planted the seeds for a more transparent trading environment? The debate raged on, pushing for regulatory changes in how these trades happen.

4. Impact on Financial Regulation

The aftermath of the Gamestop stock surge sent regulators into a tizzy. The SEC ramped up measures, focusing on making trading practices more transparent. Proposed rules, including those around payment for order flow, aimed to level the playing field for retail investors. It became clear that if Wall Street wanted to make dances with the public’s money, they’d have to do it on the up-and-up!

5. Institutional Reactions and Market Sentiment

Hedge funds, traditionally the titans of the investing world, were reeling from the Gamestop stock fallout. We’re talking major losses here; firms like Melvin Capital felt the pinch due to their hefty short positions. This was a wake-up call for the big players, forcing them to rethink their strategies. Turns out, retail investors weren’t just side characters in this drama—they’ve become the protagonists able to challenge the status quo!

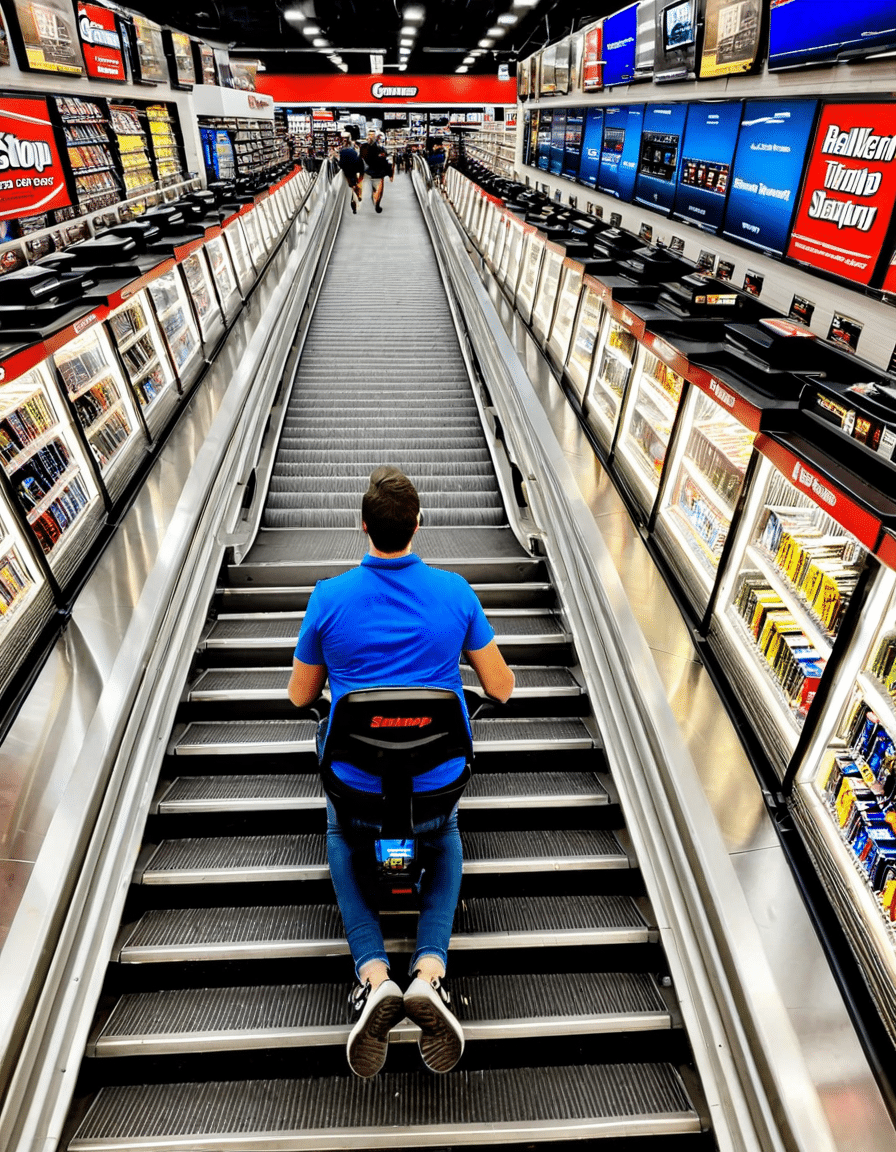

6. The E-Commerce Surge

The wave created by Gamestop stock didn’t just affect investors; it breathed new life into the company itself! After the stock skyrocketed, Gamestop took steps to revamp its business model, focusing on e-commerce and digital services. This strategic pivot attracted investors who saw potential growth. In the world of retail, adapting is key, and this move highlighted just how vital it is for businesses in today’s market landscape.

7. Increased Financial Literacy

With all the buzz around Gamestop stock, many folks found themselves diving headfirst into the world of finance. Suddenly, people were engaging with resources like Investopedia and YouTube channels specializing in finance. The desire for financial literacy wasn’t just a trend; it became a movement! Many now understand market dynamics better, leading to informed decision-making.

The Long-Term Implications of the Gamestop Stock Phenomenon

Looking forward, the Gamestop stock incident serves as a valuable case study for investors and regulators. It highlighted the power of social media in collective action and the undeniable impact it has had on Wall Street. With retail investors now more informed and organized than ever, it’s all about how this group and institutional players can coexist in this brave new financial world.

The push for innovative funding models and responsible trading practices is more crucial than ever. As retail investors continue to rise, the conversation around the relationship between them and institutional giants may well dictate the financial trends and attitudes for years to come.

As we close the book on this chapter, one question lingers: how will innovations and regulatory tweaks arising from this saga shape the next decade of investing? Only time will tell, but one thing’s for sure—the Gamestop stock phenomenon isn’t just a blip in history; it’s a pivotal moment that’s reshaping the financial landscape for generations to come!

So grab your popcorn and stay tuned, because this story is far from over! And who knows, maybe one day we’ll be watching the Gamestop stock saga unfold in its very own blockbuster film!

Gamestop Stock: A Wild Ride Through Market Madness

The Rise to Fame

The gamestop stock phenomenon wasn’t just about numbers; it became a cultural event. As retail investors rallied behind the stock, the transformation of a struggling video game retailer into a market darling echoed the flair of Madonna in the ’80s, taking the world by storm with unforgettable energy. Social media platforms became battlegrounds where memes and trading tips flew faster than a shark blow dryer could blow a lock of hair! This frenzy wasn’t just hype; it represents a shift in how everyday folks can sway Wall Street.

Drama and Community Spirit

The audacity of the gamestop stock surge even inspired communities to unite over a common goal, mirroring the camaraderie shown in stories like My Brilliant Friend, where friendship is central to overcoming challenges. As investors shared tips and strategies, the thrill of hunting for the next big move paralleled watching TV shows filled with intense drama, leaving many glued to their screens. Wall Street’s response felt like a plot twist, reminiscent of engaging soap opera gh spoilers, where audiences are always on the edge of their seats, waiting for the next turn.

Personal Branding and Market Strategies

Interestingly, this unusual market event has opened doors for many in terms of personal branding Strategies. Individuals capitalized on their newfound fame, showcasing their trading methods and sharing insights in various platforms. This scenario reflects the rise of influencers and entrepreneurs today, like Kaitlyn Bristowe and Jason Tartick, who thrive on their personal stories and unique brands. As the story of gamestop stock continues, it’s clear that the power of individuals in the market can totally reshape the investment landscape, much like how businesses utilize powerful branding techniques in their marketing efforts.

In a twist of fate, as investors ventured into this tumultuous sea of trading, it has become evident that the journey of gamestop stock is much more than just a financial tale—it’s a global narrative showcasing resilience and innovation in the face of uncertainty. In this day and age, one thing is for sure: none of us will forget the day when a video game retailer rocked Wall Street to its core.