It’s that time of year again, folks! The annual tax season is upon us, and for many, it can feel like a labyrinth full of forms, deduction traps, and endless calculations. But fear not! Just like our favorite pop culture heroes—whether it’s the sharp-witted Nurse Jackie, the ever-fearless Luffy, or the resourceful Joe Dirt—you too can be a Tax Slayer. If you want to pocket a bigger refund this year, you’ve come to the right place! Here’s a treasure trove of strategies to help you boost that refund and march confidently into tax season.

Top 7 Tax Slayer Tips for Your 2026 Refund

1. Leverage Tax Credits Like Nurse Jackie

Ever notice how Nurse Jackie always finds a way to make every situation work for her? Tax credits work similarly—they can take a big chunk out of what you owe! For 2026, there are two standouts you shouldn’t overlook:

Don’t leave that kitchen door open when a bear is outside, folks; grab those credits and stuff your refund full!

2. Deduct Medical Expenses, Just Like Madam Secretary Tackles Challenges

In the same way Madam Secretary navigates the political terrain, you can navigate through your medical expense deductions. Here’s the scoop: You can deduct eligible medical expenses that pile higher than 7.5% of your adjusted gross income (AGI).

So, keep those receipts! Anything from doctor visits to physical therapy can be included. Have you paid for health insurance premiums out of pocket? Include those too! More deductions mean a fatter refund, and who doesn’t want that?

3. Invest in Retirement Accounts Like Joe Dirt Invests in Memory

Let’s give a round of applause for Joe Dirt and his charm—it shows us how investing in yourself pays off. By funneling some of your hard-earned cash into a retirement account—think IRAs or 401(k)s—not only do you get a tax deduction now, but you start shaping a secure future.

These investments can save you bucks today and reward you later down the road. It’s like planting seeds for future growth. You’ve gotta water those seeds, so don’t waste the chance to contribute!

4. Consider Dependent Benefits Like John Rocker’s Unmatched Dedication

If John Rocker taught us anything, it’s about rising to the occasion. On your taxes, being aware of dependent benefits can do just that! You can grab deductions for eligible kids, elderly relatives, or other loved ones who depend on your finances.

It’s important to do your homework. Understanding your eligibility can lead to significant savings. Just like an unexpected home run, these benefits can boost your returns in surprising ways!

5. Explore Education Deductions as Mickey 17 Explores New Frontiers

As we gear up for the release of Mickey 17, exploring educational expenses can unlock serious deductions. The American Opportunity Credit and Lifetime Learning Credit are like golden tickets for eligible students or their families!

Whether you’re investing in your education or footing the bill for your offspring, these credits can shrink your taxable income. Fostering knowledge is an investment in the future, and a little tax help can make that journey even smoother!

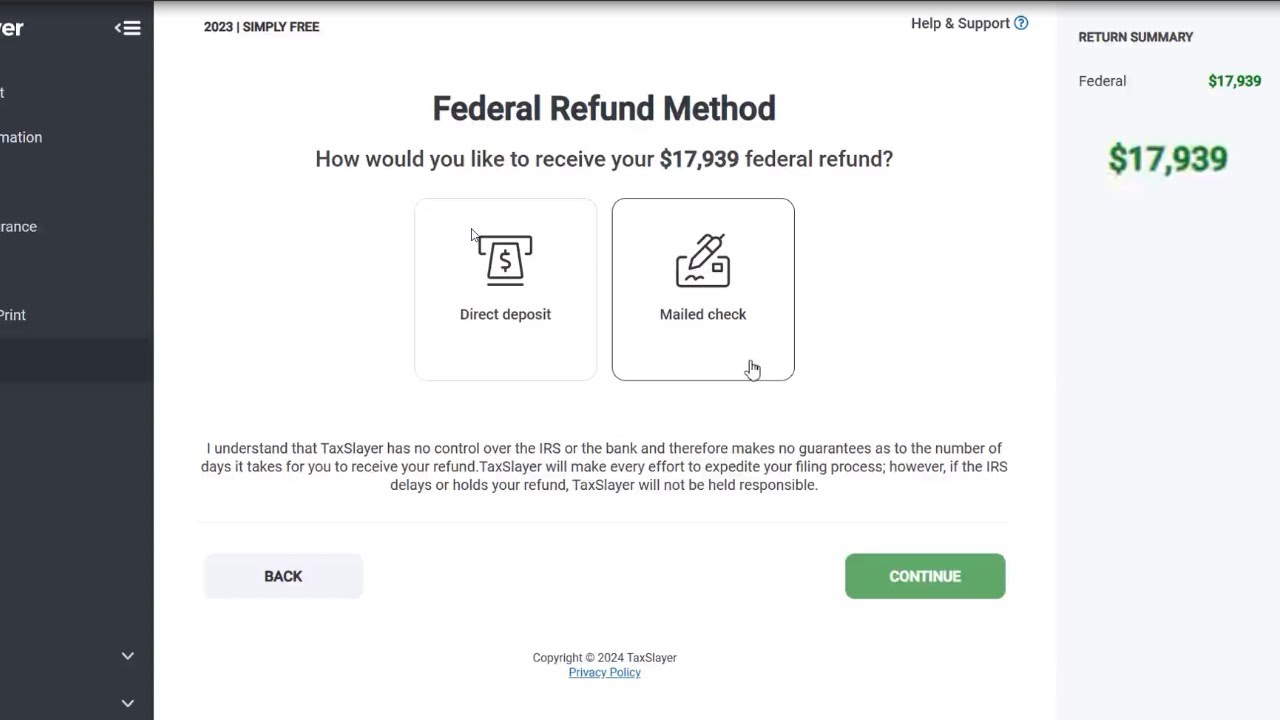

6. Optimize Your Tax Filing Approach Like Luffy Gears Up for Battle

Famed for his resilience, Luffy knows how crucial preparation is. Don’t go into tax season blindfolded! Use software like TurboTax or services like H&R Block. They guide you through the maze of deductions and credits, ensuring you catch every penny due to you.

With these tools at your fingertips, filing can feel less like crunch-time chaos and more like a strategic battle plan. You’re in the driver’s seat—own it!

7. Use Tax Timing to Your Advantage Inspired by King Von’s Strategic Moves

Here’s a trick often overlooked: timing. Just like the clever moves by King Von, knowing when to push your income can save you big bucks. If you suspect your income may dip next year, consider delaying some income until the next tax year.

This technique could lower your tax liability and boost your refund. It’s a savvy approach if you see dollar signs. Remember, wrong timing can cost you; right timing can be your financial game-changer!

Innovative Wrap-Up of Tax Slayer Insights

Maximizing your tax refund in 2026 is all about adapting, just like our beloved pop culture heroes. Be it the resourcefulness of Nurse Jackie or the adventurous spirit of Mickey 17, think of taxes as a challenge to conquer! By employing these seven Tax Slayer strategies, you’re gearing up for the best tax season yet.

So roll up your sleeves, plan methodically, and jump on those smart deductions and credits. When tax season arrives, sail smoothly into the friendly waters of a well-deserved refund. Cheers to your financial victories; let’s make this tax season one for the books! And remember, just like a fluffy siamese kitten snuggling up to you, getting your taxes right feels warm and delightful!

Here’s to getting your money’s worth and embracing the Tax Slayer spirit! 🥳

Tax Slayer Tips for Maximizing Your Tax Refund Today

The Tax Slayer’s Secrets

Tax time might feel like a maze, but with a few tips from the tax slayer himself, you can emerge victorious! Did you know that some taxpayers miss out on deductions simply because they aren’t aware of them? For instance, think of those unexpected costs—like keeping your air conditioning in tip-top shape using an AC recharge kit! Your tax slayer journey could take you through overlooked expenses that can add up to your refund, kinda like the way munchkin cats have an average life expectancy Of Munchkin Cats that surprises many.

Claiming Every Dime

Moving on, did you ever ponder how certain professions can unlock unexpected tax perks? Tax slayers know that freelancers and gig workers, just like those folks chasing fame like Big Ed, often have expenses they can claim. Not to mention, if you’ve got a creative side and have dabbled in content creation, you might find that equipment count as a business expense too! Remember, being informed is part of the tax-saving game, just like finding the best Beaches in The Us can make for a great vacation.

Deductions that Surprise

Last but not least, a lot of people forget about those quirky donations—think beyond clothes and furniture. Tax slayers often share their stories about how contributing to local charities or community organizations doesn’t just help others; it can give them a leg up on their tax returns too! Moreover, don’t be surprised by how creativity can pay off, even in tax deductions. Much like how Johnny Sins redefines roles in the adult film industry, think outside the box with your deductions. And don’t let life slip by without catching those tax breaks, folks; every little bit counts to ensure you’re getting the most out of those refunds and staying sharp in your financial game.

So gear up with these tips; unleash your inner tax slayer and tackle your tax season with gusto. Stay savvy, and remember, it’s all about maximizing every single opportunity that comes your way! And for those still on the fence about financial literacy, there’s always valuable information like that found at Series Biblicas net for diving into topics that can enrich not just your tax game, but life in general.